SA batteries paid to charge as solar sends electricity prices negative

December 2, 2021

Batteries in South Australia have been paid to charge throughout September and October 2021 due to a record number of negative price intervals. Wholesale electricity prices were negative almost 40% of the time.

The chart below from the Energy Synapse Platform shows the average intraday generation and price profile for South Australia in September. The lowest prices occur in the middle of the day, due to an abundance of solar energy (particularly rooftop solar). Solar creates a “duck curve” not only in the demand profile, but also in the price profile. This sends a signal for energy storage to soak up excess solar, and discharge the power at more valuable times (such as the evening).

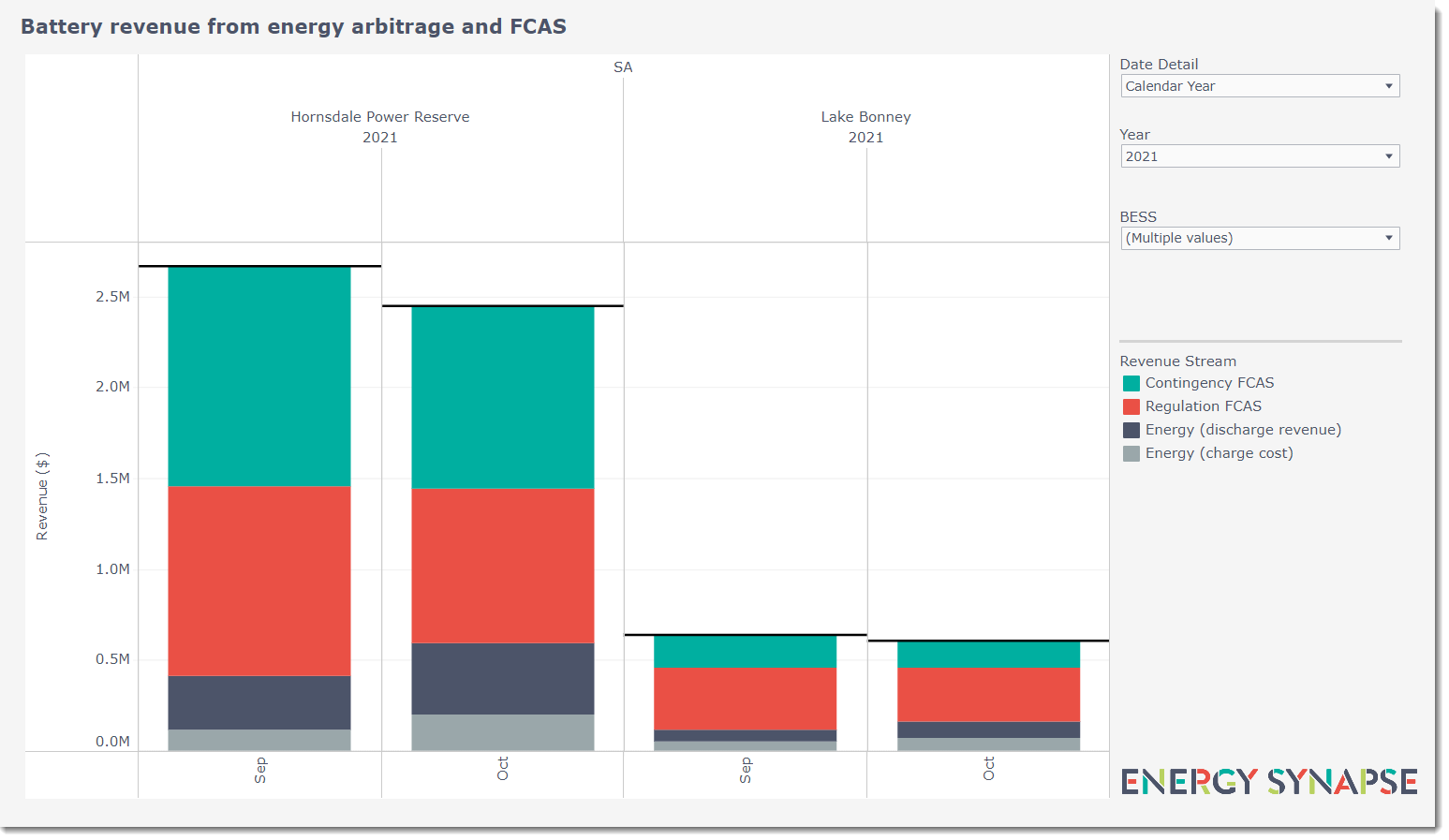

Batteries normally incur a cost when they purchase wholesale energy to charge. However, as can be seen in the Energy Synapse Platform, “charging costs” were a positive revenue line item for the Hornsdale Power Reserve and Lake Bonney battery in South Australia. The 150 MW Hornsdale Power Reserve earned more than $300k from charging over the two months, while the 25 MW Lake Bonney battery earned over $100k.

Negative energy prices were certainly a welcome boost for batteries. However, it is important to note that frequency control ancillary services (FCAS) remain the dominant revenue stream.

Solar farms without batteries face an economic limit

As more solar is added to the grid, daytime prices get lower and lower. This places an economic limit on how much solar (without storage) can be deployed in a market.

The Tailem Bend solar farm in South Australia has a modern PPA structure, which requires it to turn down to avoid negative prices. This is known as “economic curtailment”. Tailem Bend was also subject to multiple physical grid constraints, which limited its output. We can see the significant impact this had on the operation of the asset during September in the Energy Synapse Platform. The net result was that the average capacity factor was drastically cut to around 20% in the middle of the day when the natural output of the asset would have been the highest.

Apart from building more big batteries, there is also an opportunity to encourage more demand side resources to “flex up”. This can come from a wide variety of technologies such as hot water systems, residential batteries, and even new industries like green hydrogen.

Author: Marija Petkovic, Founder & Managing Director of Energy Synapse

Follow Marija on LinkedIn | Twitter