Overcoming barriers to battery investment

April 10, 2025

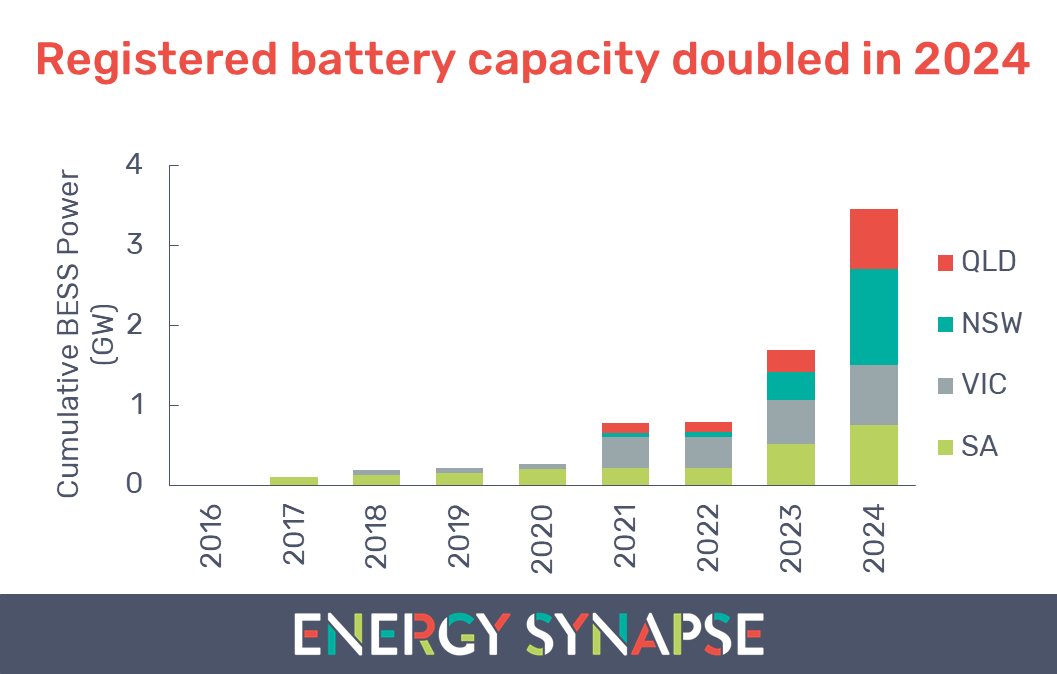

Investment in utility-scale batteries is rapidly accelerating in Australia’s National Electricity Market (NEM). Registered battery capacity doubled in 2024 to over 3 GW, with a further 90+ GW under development.

Energy Synapse Managing Director Marija Petkovic was invited to speak at Smart Energy 2025 about how we are overcoming barriers to investment.

Snapshot of key investment barriers we have overcome

▶️Establishment of frameworks for transmission network service providers (TNSPs) to procure system strength and synthetic inertia services from batteries with grid forming inverters, which will help keep the grid stable as we transition to being fully renewable. These services are being procured via bilateral agreements, often long term, which is a big boost to the bankability of BESS projects. For example, Koorangie Battery in Victoria secured a 20-year agreement to provide system strength services starting from 2025.

▶️Expansion of state based System Integrity Protection Scheme (SIPS), which harnesses the power of batteries to act as virtual transmission. This is also done via bilateral agreements, which improves revenue certainty. Several batteries have SIPS agreements including Horndale Power Reserve, Victorian Big Battery, and Waratah Super Battery.

▶️Introduction of fast frequency response (1-second) markets, which reward the unmatched speed of batteries.

▶️Establishment of market registration and operational frameworks (under IESS rule change) for BESS hybrid projects, leading to an explosion of hybrid projects under development.

▶️Innovation in offtake agreements to manage revenue risks and improve bankability. For example, through physical tolls, virtual tolls, time based swaps and more.

Policy uncertainty around coal closures remains a major barrier to battery investment

While we have made amazing progress, one major barrier to battery investment remains: policy uncertainty around coal closures.

AEMO’s Integrated System Plan sets out a path for Australia’s energy transition. However, we have seen uncoordinated responses from state governments in Victoria, New South Wales, and just this week in Queensland to extend the life of coal-fired power stations. Industry is also battling policy uncertainty at the federal level with a looming election.

Greater certainty on the timing of coal closures will give industry more confidence to make appropriate investment decisions. This is especially important for medium and long duration storage.

RenewEconomy has quoted Marija Petkovic’s comments on policy and coal closures.