Hornsdale Power Reserve earns record revenue in September 2019

October 21, 2019

The world’s biggest lithium-ion battery, the 100 MW/129 MWh Hornsdale Power Reserve in South Australia, has just earned its biggest monthly revenue from wholesale markets.

The ‘Tesla big battery’ as it is commonly known, was famously brokered via a deal on Twitter and has been operating in Australia’s National Electricity Market (NEM) since late 2017. We recently published independent analysis, which provides a deep dive into the operation, merchant revenue, and bidding strategies of the Hornsdale Power Reserve from January 2018 to September 2019. In this article, we look at just one of the many insights from the report.

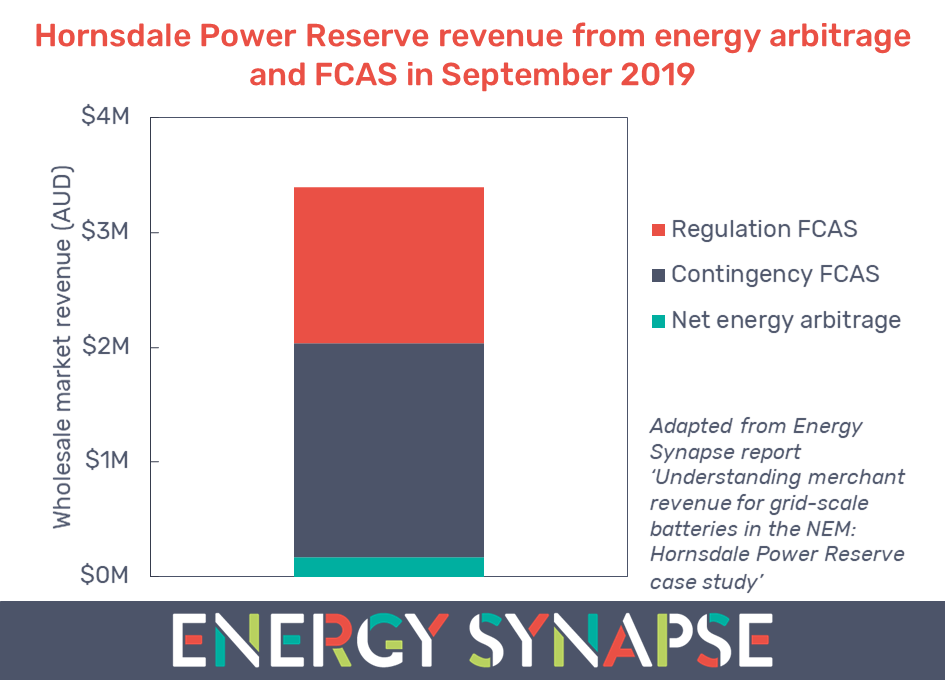

Our analysis shows that the Hornsdale battery earned approximately $3.4 million from wholesale markets in September 2019 (see chart below). This is the highest monthly revenue that the battery has achieved. Note that this is inclusive of the cost of charging the battery. However, it does not include non-market revenue streams (such as the contract it has with the South Australian government), FCAS payments under the causer pays methodology, or any other factors which are private to the operator.

The overwhelming majority of revenue in September came from providing frequency control ancillary services (FCAS). Contingency services, which correct major frequency deviations in the grid, accounted for the highest share of revenue (55%). This was due to a strong rebound in contingency FCAS prices. In September 2019, the Australian Energy Market Operator (AEMO) made changes to how it calculates FCAS requirements. This has resulted in a higher volume of contingency FCAS being procured, which has contributed to the upward pressure on prices.

Operating batteries has a learning curve

At a high level, the revenue that a battery can earn each month and how this is split across various markets, depends on two factors:

1. Prevailing market conditions; and

2. The strength of the battery’s trading strategy.

The Hornsdale battery may have earned the single highest monthly revenue in September, but it also missed significant opportunities throughout the month. In our analysis, we compare the actual operation of the Hornsdale Power Reserve with our optimised operation model. This comparison shows that there was potentially more than $1.1 million of additional revenue available in the market in September. This highlights the complexities of operating batteries under real world conditions and uncertainties.

Batteries are unlike any other asset in the NEM. A generator, such as a coal or gas plant, can theoretically keep producing electricity as long as the fuel continues to be supplied. In contrast, a battery has a limited capacity to charge or discharge energy at any point in time. As a result, previous charge/discharge decisions can have a big impact on future revenue. There is still much to learn about how to operate batteries in the most profitable way.

Author: Marija Petkovic, Founder & Managing Director of Energy Synapse

Follow Marija on LinkedIn | Twitter