Victoria sets new record for electricity prices

February 1, 2018

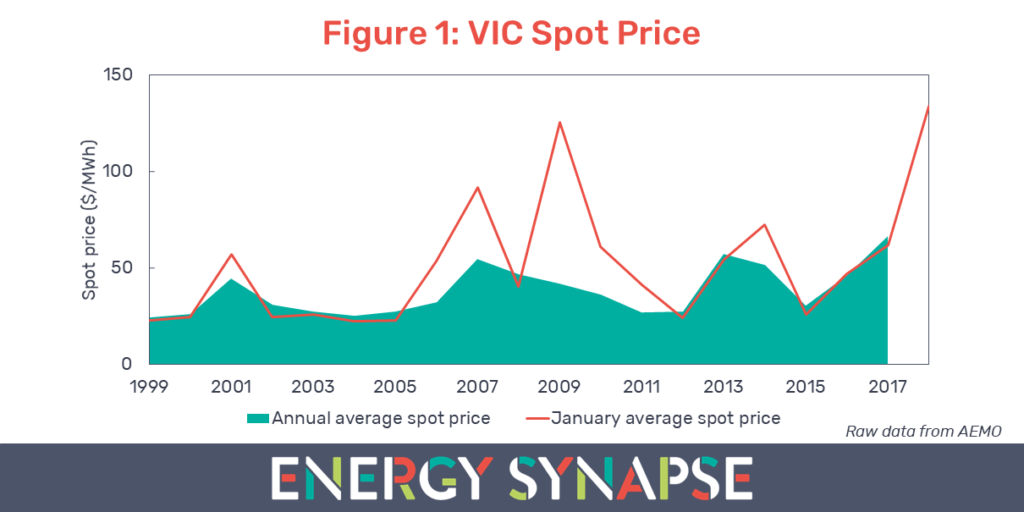

Victoria has traditionally been considered the “boring state” when it comes to volatility in wholesale electricity prices. But that all changed last month when the average spot price for Victoria hit $133.48/MWh, setting a new record for January prices for the state. January 2018 narrowly missed out being the highest flat average for any month, only being surpassed by June 2007 ($143.28/MWh).

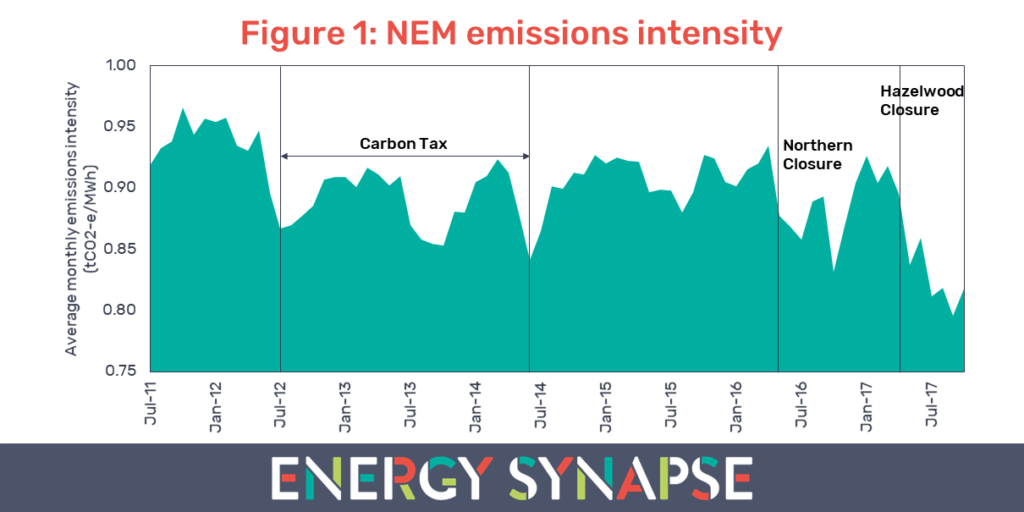

This increase in volatility comes on the back of 2017, which saw several factors come together to create an unprecedented energy crisis in the National Electricity Market (NEM). Some of these key factors include a decade of policy uncertainty, exit of ageing generation, high gas prices, outdated market rules, and a lack of competition. The energy crisis during 2017 produced the highest annual average spot price for Victoria ($66.58/MWh) since the commencement of the NEM in the late 90s. Despite energy becoming one of the hottest issues in government and the media over the last 18 months, high pricing has continued into 2018 as seen in Figure 1.

January 2018 has been unusually hot for Victoria. According to long term climatic data from the Bureau of Meteorology, Melbourne has an average of 0.7 days with temperatures ≥ 40°C during January. January 2018 had three days that exceeded 40°C. In contrast, January 2017 had none, and January 2016, only one. Furthermore, this is the first summer without Hazelwood, a 1600 MW brown coal fired power station that closed at the end of March 2017.

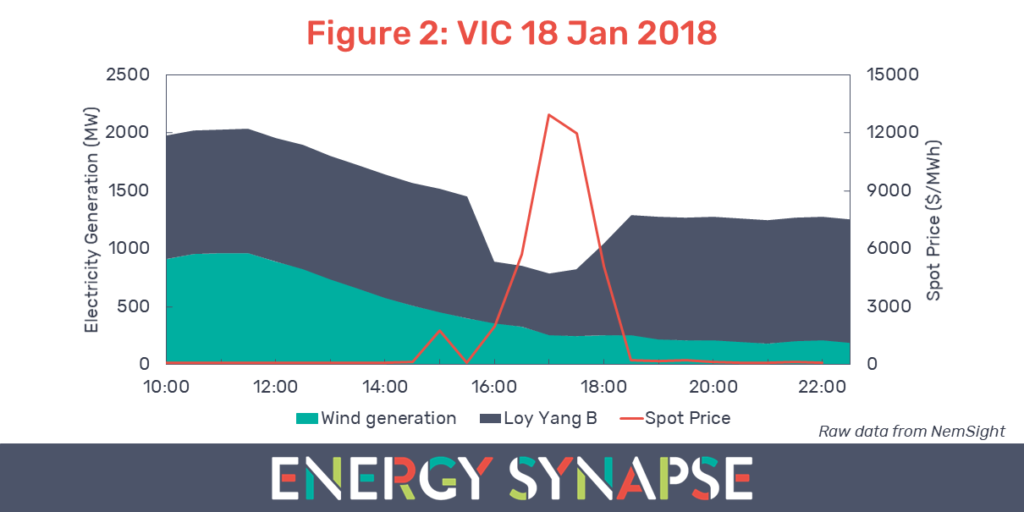

Victoria had four days in January where spot prices exceeded $2,000/MWh, compared with zero in the whole of 2017, and only two during 2016. The highest pricing came on Thursday the 18th of January 2018. The spot price peaked at $12,931.04/MWh during the 5pm trading interval, setting a new record for the highest ever 30 minute spot price in Victoria. A scorching heatwave drove electricity demand up to relatively high levels. However, the 18th was only the third highest demand day in the month. We were able to take a deeper dive into how the day unfolded by using NemSight, a software created by Creative Analytics (part of the Energy One Group).

Coal and wind generation were both less available

As can be seen in Figure 2, Loy Yang B, Victoria’s newest and most efficient brown coal-fired power station, tripped in the afternoon resulting in a sudden loss of 525 MW. Furthermore, wind power availability was about 700 MW lower than earlier in the day. Although this loss of generation was much more gradual. Nonetheless, reduced availability of coal and wind were both significant. This is because both are very cheap sources of power.

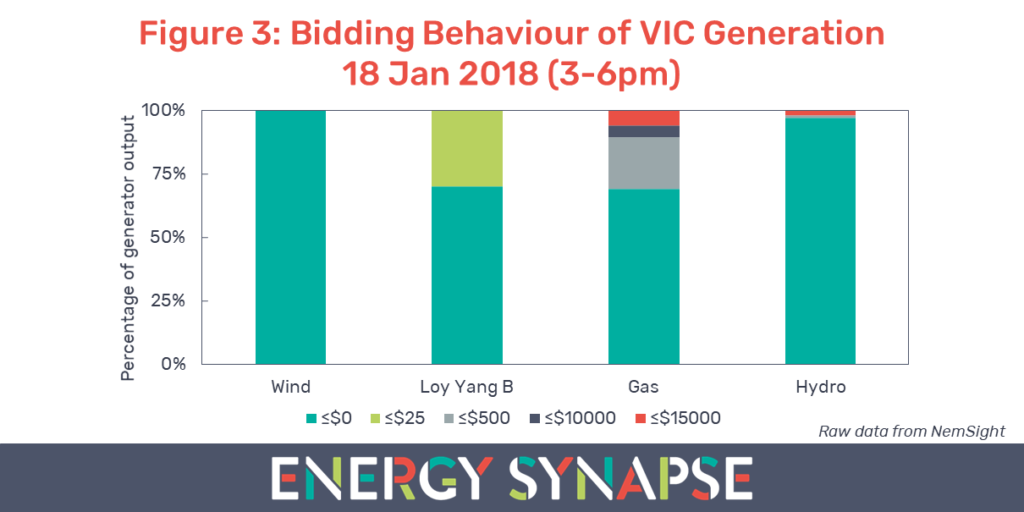

The generator bidding data in NemSight shows that all Victorian wind farms were bidding 100% of their output at prices ≤$0/MWh. Similarly, Loy Yang B was bidding all of its output at prices ≤$25/MWh. The reduced availability of this cheap electricity made Victoria more dependent on the highest priced gas and hydro generators, who were bidding in excess of $10,000/MWh, and thereby driving up prices. Figure 3 shows a summary of the bidding behaviour during the peak price period from 3 to 6pm.

Smart energy to pave the way forward

The events of the 18th of January highlight another point. When it comes to the reliability and affordability of electricity, it is not a battle between renewable energy and fossil fuels. Thermal generators are susceptible to failure at high temperatures. While intermittent renewables, such as wind, are dependent on prevailing weather conditions and hence are largely out of our control. Neither characteristic is effective for meeting peak demand reliably. Rather than waging a war between renewable energy and fossil fuels, we should be thinking about how we can make our energy systems more intelligent and resilient with enabling technologies such as energy storage, demand response, and predictive analytics. Smart energy is the key to a cleaner, cheaper, and more reliable electricity grid.

Author: Marija Petkovic, Founder & Managing Director of Energy Synapse

Follow Marija on LinkedIn | Twitter