Batteries in South Australia earn $1 million over two days

December 24, 2019

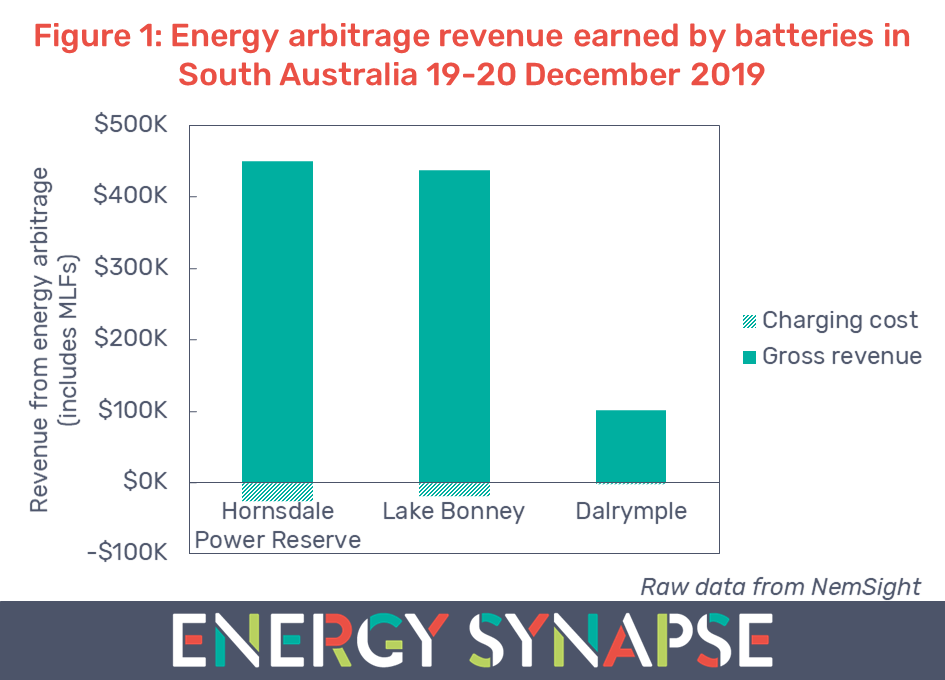

Grid-scale batteries in South Australia earned almost $1 million from the energy market over two days from 19-20 December 2019 (see Figure 1) as the nation sweat through an extreme heatwave.

This revenue is just from arbitraging the wholesale energy market and includes the cost of charging the batteries as well as marginal loss factors (MLFs). It does not include revenue from frequency control ancillary services (FCAS) or any bilateral contracts.

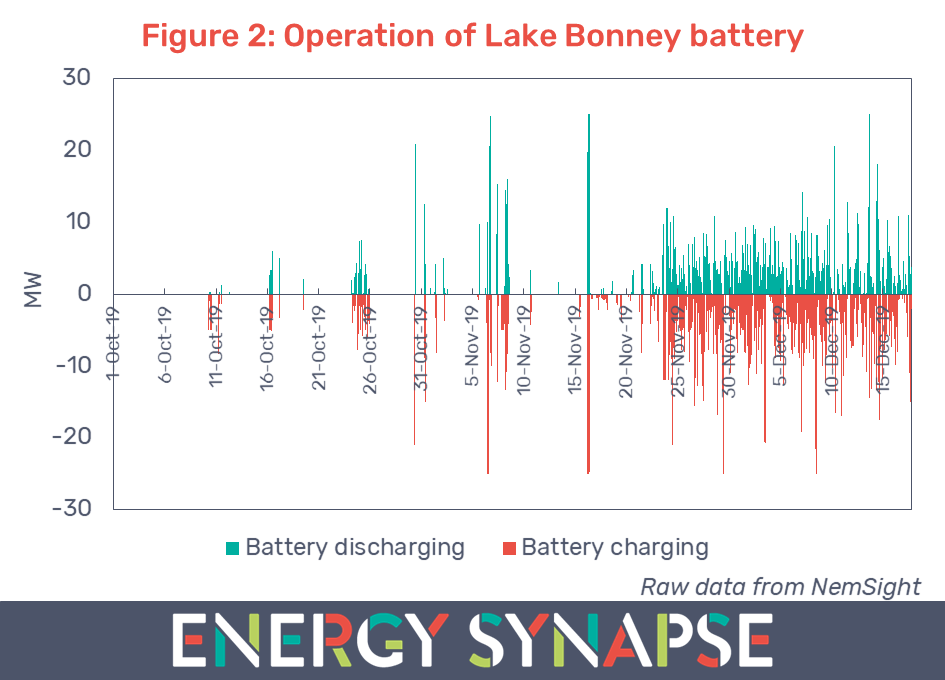

These earnings will be especially welcome news for Infigen’s new 25 MW/52 MWh Lake Bonney battery. The Lake Bonney battery, which cost $38 million, was only recently energised (October 2019) and appears to have started commercial operation in late November (see Figure 2).

The 100/129 MWh Hornsdale Power Reserve (HPR) has been operating the longest (since late 2017). Despite being a bigger battery, the HPR earned similar revenue to the Lake Bonney battery. This is because the HPR has only 30 MW/119 MWh available for commercial operation in the energy market.

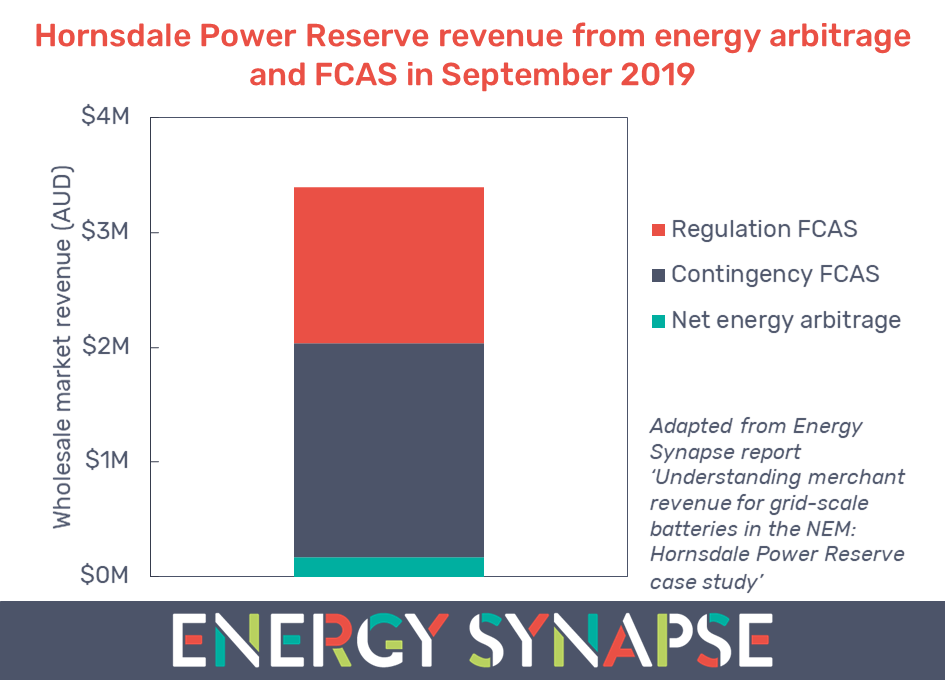

We recently published a comprehensive 21 month analysis of how the Hornsdale battery has been operating, bidding, and earning revenue from energy arbitrage and all eight FCAS markets. Our independent analysis is supported by the Australian Energy Storage Alliance and has proven to be a very valuable resource for developers and investors of battery storage. In 2020, the HPR will be getting 50% bigger and will be demonstrating a range of new grid services, including fast frequency response.

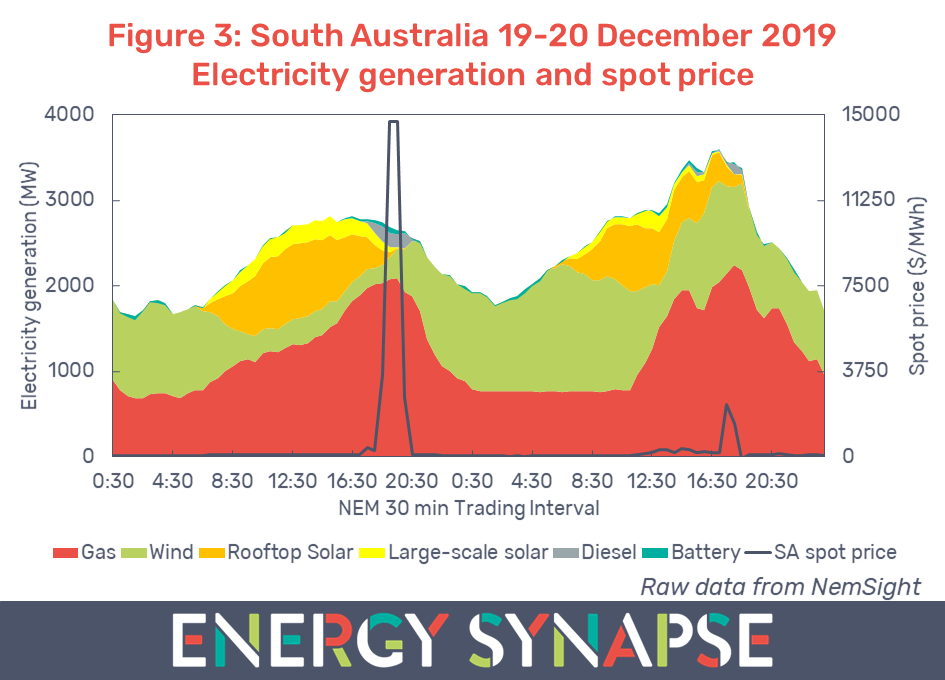

Batteries seize opportunity as Australia sweats through three hottest days on record

The very high daily revenue earned by batteries last week coincided with the first price volatility of the season. The spot price in South Australia hit the market cap of $14,700/MWh for an hour on Thursday 19 December (see Figure 3). Tuesday, Wednesday, and Thursday of that week were the three hottest days ever recorded in Australia.

Figure 3 shows that the high pricing also coincided with low electricity generation from wind and solar. As a result, expensive gas and diesel generators were needed to meet demand. Being both dispatchable and fast responding, batteries were well placed to take advantage of this volatility in pricing.

This highlights a broader economic challenge for wind and solar farms. Wind and solar farms have a marginal cost of zero. As a result, they put significant downward pressure on electricity prices at the time at which they are generating electricity. However, because they are weather dependent, their operators cannot ramp up production to take advantage of high prices.

As the uptake of variable renewable energy grows, the earnings gap between renewables and other market participants will continue to increase. Energy storage is of course, one of the solutions to this problem. Thus, we can expect renewable energy projects to increasingly incorporate storage to help manage this risk.

Get the comprehensive Hornsdale Power Reserve case study

Author: Marija Petkovic, Founder & Managing Director of Energy Synapse

Follow Marija on LinkedIn | Twitter