How sodium-sulfur batteries can help bridge the storage gap in the energy transition

April 8, 2024

As Australia’s coal-fired power stations progressively close over the next 10-15 years, it will be critical to ensure that the grid has enough storage to balance variable supply from wind and solar.

The size of energy storage systems is described by two parameters:

(1) the maximum power they can discharge into the grid; and

(2) their storage duration i.e. how long they can keep discharging at maximum power.

To date, the rollout of utility-scale battery storage in Australia has been dominated by lithium-ion batteries with short storage durations of two-hours or less. Batteries have big advantages in that they are modular, can be rolled out relatively quickly, and are not dependent on unique geographic formations.

However, long duration energy storage (LDES) has an important role to play in derisking the clean energy transition by protecting against prolonged droughts in wind/solar output. The federal government as well as the Queensland state government have both committed significant resources to pumped hydro projects. For example, Snowy 2.0 is expected to have almost a week’s worth of storage while Borumba Pumped Hydro could have up to 24 hours. However, these pumped hydro projects are incredibly complex and have long lead times. There is an opportunity for alternative battery chemistries, such as sodium-sulfur, to help bridge the gap between lithium-ion batteries and pumped hydro by providing medium-to-long duration storage within a much shorter lead time.

Energy Synapse sat down with Ross Sang, an expert in sodium-sulfur batteries, to get his insights on how this technology can help Australia transition to clean energy. Ross is National Business Manager, Energy Storage at BASF Australia (provider of NAS® batteries). BASF has recently been announced as a successful proponent in a battery trial designed to boost reliable renewable supply for regional WA.

Ross Sang, BASF Australia

Can you tell us more about sodium-sulfur (NaS) battery technology and how it has been rolled out internationally?

NAS® batteries were the first commercialised battery energy storage technology designed for large-scale stationary application. They have a successful track record over more than 20 years and have been deployed at more than 250 locations worldwide with a total power exceeding 720 MW and a storage capacity of approximately 5.0 GWh. It may be a surprise to many, that the largest battery in the world in 2016 was a 50 MW / 300 MWh NAS® battery that was constructed in 6 months in Japan and remains operational today.

What is the sweet spot for sodium-sulfur batteries in an Australian context?

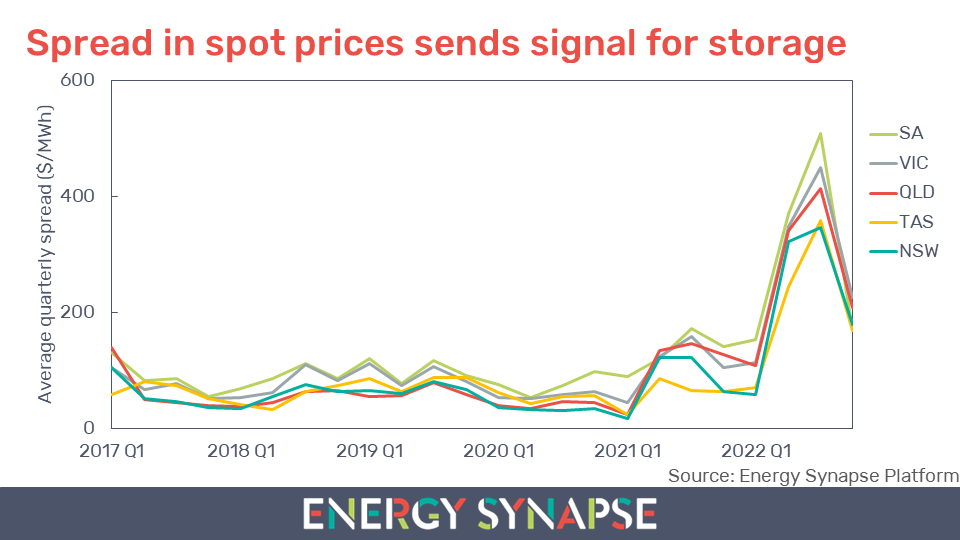

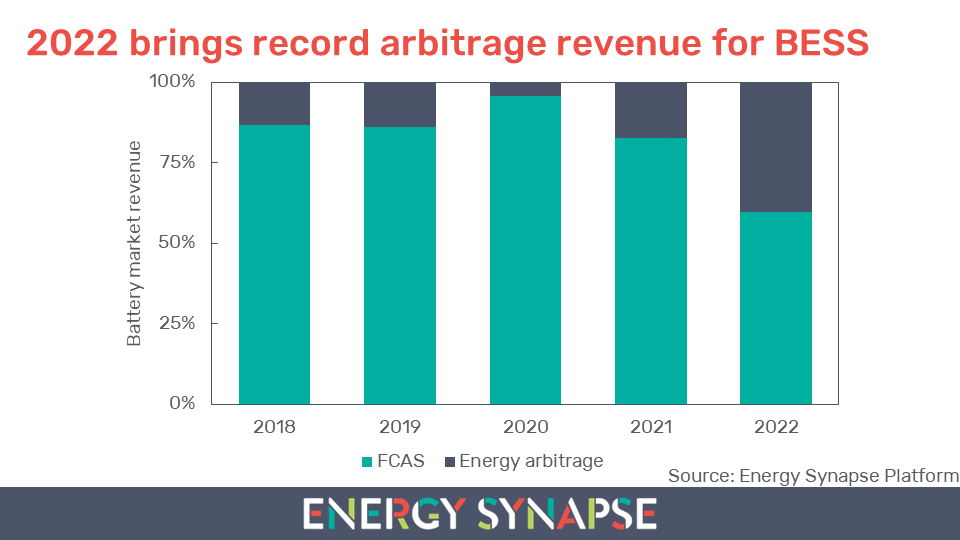

The primary role of NAS® batteries in the energy transition is to support decarbonisation through energy arbitrage. This involves shifting large amounts of renewable energy to periods of low generation on a daily basis. The NAS® batteries large energy capacity and optimal discharge duration of 6-8 hours can support the displacement of fossil fuels in microgrids, industrial processes, and power generation and can be scaled up to hundreds of megawatts to support Australia’s path to its renewable energy targets on the grid.

What do you see as the main advantages of NaS batteries compared with other long duration storage technologies?

NAS® batteries operate at high temperature so they are not affected by ambient temperatures and do not require air-conditioning or a fire suppression system. This means they are particularly well suited to many arduous environments and have a very predictable degradation. This was well proven last year, whilst the first Australian NAS® battery was being commissioned at 45°C in Western Australia, another system was coincidentally being commissioned in South Korea at an ambient temperature of -18°C.

Furthermore, these attributes along with a number of others, mean the NAS® batteries have low maintenance requirements and the containerised design enables fast and simplified installation on site leading to a much shorter construction time compared to other LDES technologies.

Are there any unique considerations that project developers and EPCs need to take into account if they are thinking about using NaS technology in their projects?

As mentioned, the standard 20ft containerised form factor of NAS® batteries allows straightforward installation at the project site, and as the containers can be stacked, the footprint is relatively small. Due to the C-rate of 1/6, NAS® batteries are suited to applications of 6 hours or more and when paired with suitable Power Conversion Systems the NAS® batteries impressive response rate of <10ms can be utilised to perform advanced grid stabilisation services.