Battery storage – Why accurate price forecasting is key to capturing revenue

March 31, 2020

A few weeks ago, I had the pleasure of speaking at the Pumped Hydro & Battery Storage Conference in Sydney. I suspect this will be the last industry gathering for quite some time.

In my talk, I covered some of the key learnings from our independent analysis of the Hornsdale Power Reserve – the world’s biggest lithium-ion battery. In this article, I’m going to recap one of those points, which centres on why batteries are such a unique asset to operate in the National Electricity Market (NEM).

Most energy analysts will agree that the fundamental value proposition for battery storage is strong as the grid continues to transition to clean, but variable energy. However, simply identifying a revenue opportunity and actually capturing that opportunity are two very different things.

Opportunity cost is the key consideration for battery storage

Theoretically speaking, a coal or gas fired generator can keep generating electricity as long as the fuel continues to be supplied. As a result, the main dispatch consideration for these assets has traditionally been whether they are covering their marginal cost.

In contrast, batteries are a fundamentally different asset. Batteries have a limited ability to charge or discharge energy at any point in time. This means that how you operate a battery right now and in the recent past, impacts your ability to earn future revenue.

There are two classic traps that a battery operator can fall into:

1. Wrongly discharging the battery: Say the price is $1000/MWh in the energy market. The battery discharges most or all of its battery capacity at this price. The price then spikes to $14000/MWh. Unfortunately, the battery was drained at lower price points and now cannot capture this high price.

2. Wrongly withholding capacity: Say the price is $1000/MWh, but the battery operator is expecting the price to spike to $14000/MWh. Hence, they withhold battery capacity in anticipation of the price spike. Unfortunately, the price spike doesn’t eventuate and it turns out that the battery should have discharged at $1000/MWh after all. In this scenario, the battery has once again missed the optimal discharge opportunity.

These two scenarios illustrate why simple trading strategies such as “battery will charge when price hits $X/MWh and discharge when price hits $Y/MWh” tend to be very ineffective. In order to operate batteries profitably, one must consider the opportunity cost of every action. This means that a battery operator needs to look into the future at possible pricing scenarios and then back calculate the optimal time to charge and discharge.

Operators who can forecast prices most accurately will be most profitable

There is a very clear conclusion from the above: The operator who is able to forecast prices most accurately will be the most profitable.

At my talk at the Pumped Hydro & Battery Storage Conference, former Prime Minister Malcolm Turnbull asked me whether these same opportunity cost considerations apply to pumped hydro. The simple answer is yes. Pumped hydro should also operate on an opportunity cost basis.

However, the main point of difference is that pumped hydro can generally store energy for many more hours than a battery (sometimes even days). This means that pumped hydro can afford to have a lower level of accuracy in its price forecasting. Consider our first scenario again. If a pumped hydro plant releases water to generate electricity at $1000/MWh, it will likely still have enough pumped water to release again at $14000/MWh.

The shorter the storage duration, the lower the margin for error. This is why accurate price forecasting is especially important for batteries.

Therefore, it is vital to understand that while a business case might look promising on paper, accurately predicting prices is key to capturing that revenue opportunity in practice.

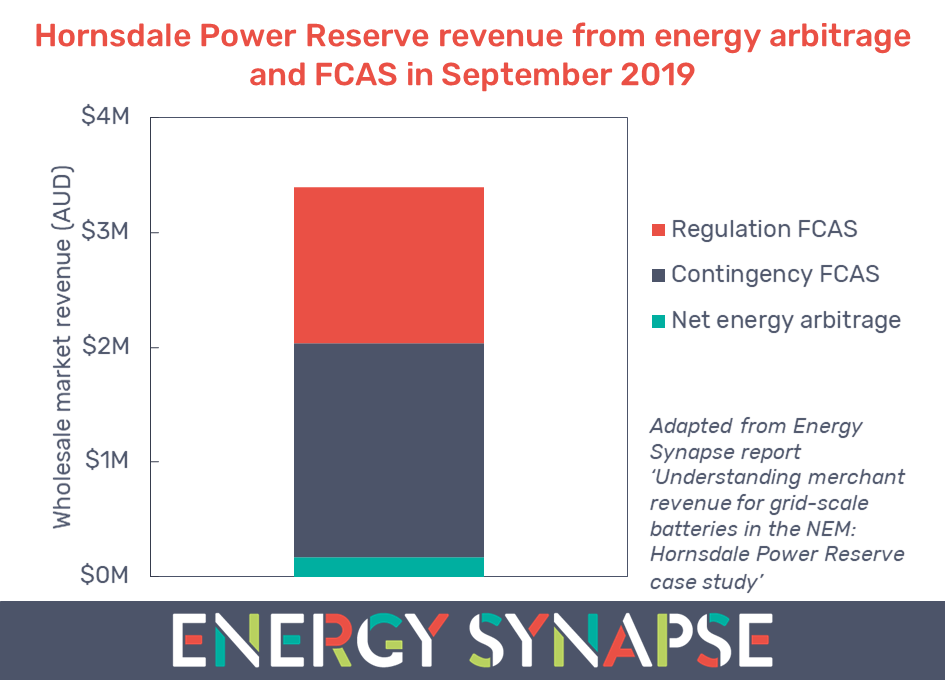

The simple illustrative examples I have given in this article only consider the energy market. There are also eight markets for frequency control ancillary services (FCAS). A battery needs to simultaneously co-optimise its operation across all of these markets in order to maximise profitability.

This is no easy feat. Electricity markets are extremely volatile compared to just about any other market in existence. Furthermore, the NEM’s somewhat unique structure (i.e. real-time energy only market) makes it especially volatile. Price forecasting is already challenging in a system of relatively unsophisticated bidders. It will become even more difficult in the future as more “smart” systems enter the market.

We are already seeing new companies cropping up and offering battery trading solutions. Others will likely follow. We anticipate that due diligence on trading algorithms and strategies will quickly become essential for any developer, investor, or operator of battery storage.

In our analysis of the Hornsdale Power Reserve, we benchmarked the operation and revenue of the Hornsdale battery against our optimised models. This gives unique insight into how well the battery is capturing opportunities in the market and what opportunities it is missing. We also explain and deep dive into the co-optimisation considerations in energy and FCAS markets.

Order your digital copy of the Hornsdale Power Reserve Case Study today. We will be donating $1000 to RenewEconomy for every purchase made by 10 April 2020. Since 2012, the team at RenewEconomy has worked tirelessly to keep us all informed of the latest news in clean energy. We want to do our part to give back to them during this difficult COVID-19 period.

Author: Marija Petkovic, Founder & Managing Director of Energy Synapse

Follow Marija on LinkedIn | Twitter