National Electricity Market year in review part 1/2: Wholesale electricity prices

January 8, 2019

2018 has been another challenging year for the energy industry. Hopes of a national policy that merges energy and emissions were dashed with the collapse of Malcolm Turnbull’s leadership in August. Nonetheless, consumers, businesses and state governments are forging ahead with the energy transition. In this special two part blog series, we will be looking back at what all of this has meant for the National Electricity Market (NEM) over the past year. This is Part 1/2 where we will be focusing on wholesale electricity prices.

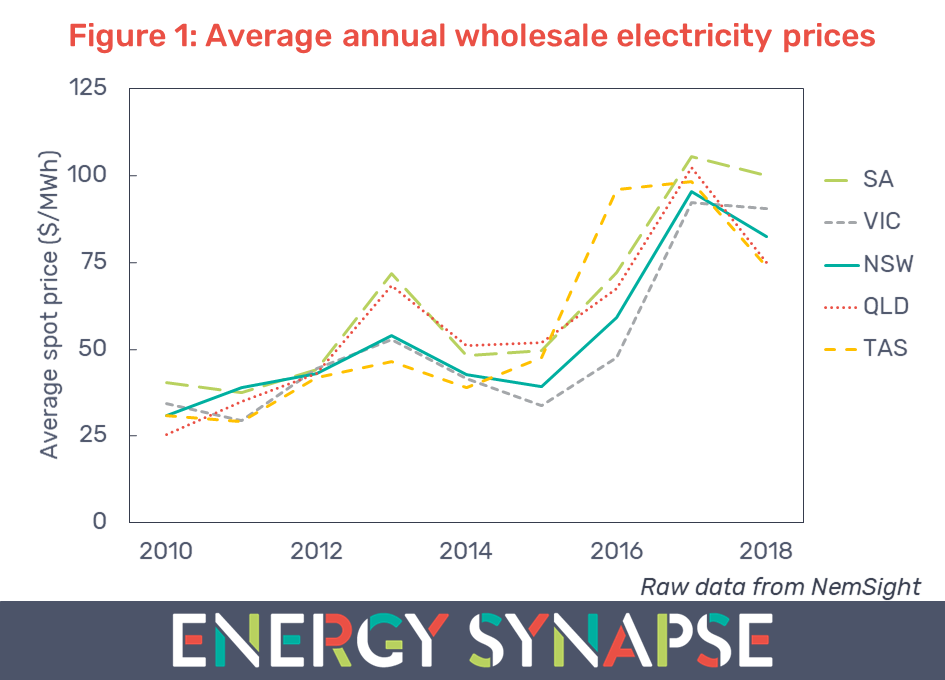

The National Electricity Market has been in the throes of an “energy crisis” for the last three years. The energy crisis has been brought about by a combination of factors coming together such as high gas prices, a decade of policy uncertainty, exit of ageing generation, a lack of competition, outdated market rules, and more. This has resulted in record high wholesale electricity prices.

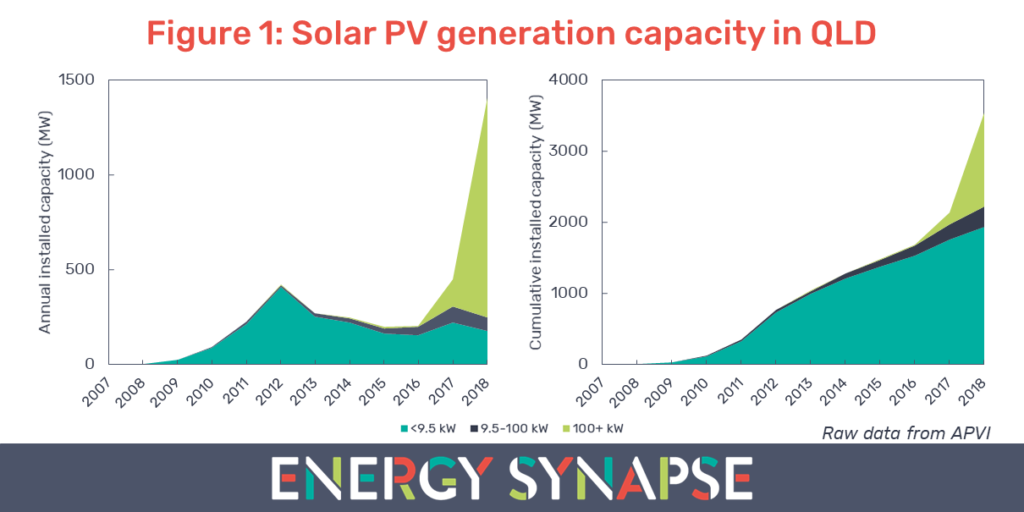

Figure 1 shows the average annual wholesale electricity price for each state from 2010 to 2018. We have compiled this data using NemSight, a software developed by Creative Analytics (part of the Energy One group). As can be seen from Figure 1, wholesale electricity prices eased in 2018 in all states, which is welcome news for consumers. However, prices still remain at very high levels relative to historical values.

State Government action led to very sharp falls in Queensland wholesale electricity prices

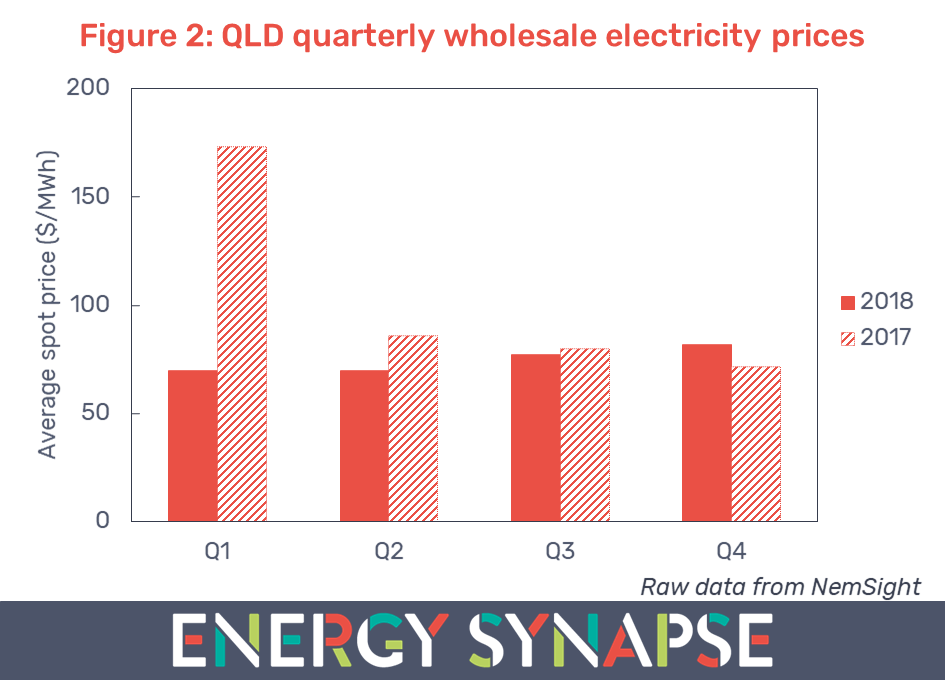

Wholesale electricity prices in Queensland fell by 27% in 2018. This is the highest price reduction out of any state. Figure 2 shows that this can be attributed to the first quarter of the year (Jan to Mar). In 2018, the average Q1 price in QLD was less than half that in 2017 ($69.99/MWh compared with $173.20/MWh). This is despite the fact that the 2017 record for the highest ever electricity demand in QLD was broken four days in a row in February 2018.

This dramatic price decrease in the face of record high demand was largely due to the Powering Queensland Plan implemented by Queensland State Government. The QLD Government owns the majority of the generation in the state. As part of the Powering Queensland Plan, Stanwell Corporation’s (state owned entity) Swanbank E 385 MW gas fired power station was returned to service.

The QLD Government also directed Stanwell Corporation to alter their bidding practices to put downward pressure on wholesale electricity prices. Stanwell is the dominant player in the QLD market and has historically used its market power to raise prices and thereby increase profits. Consequently, this direction by the state government has had a significant impact on pricing.

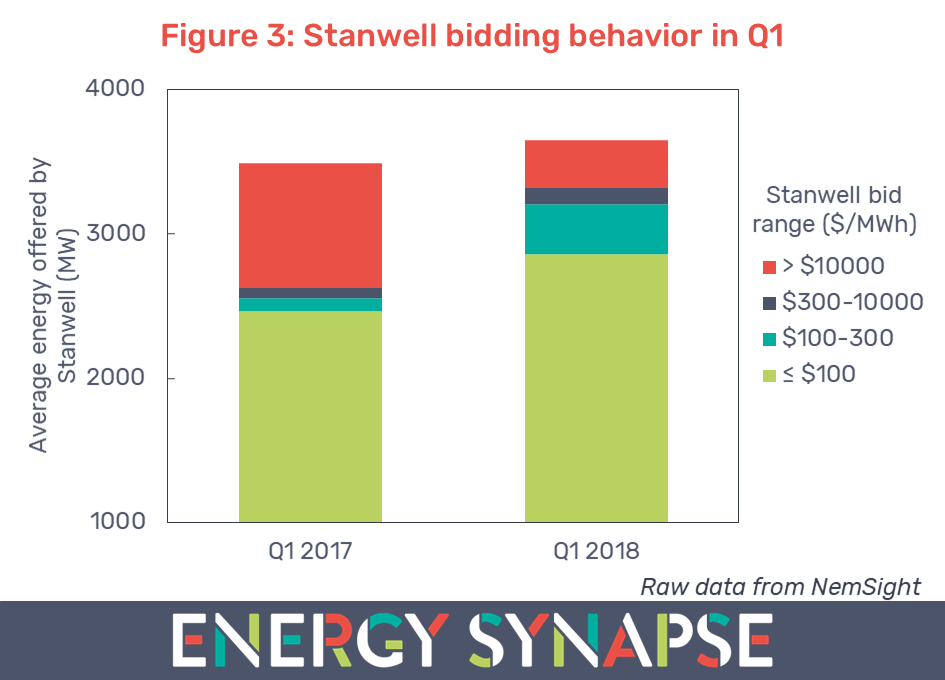

Figure 3 shows how Stanwell’s bidding behaviour has changed in the first quarter of 2018 versus 2017. It shows the average amount of megawatts that Stanwell offered into the market for each 30 minute Trading Interval and the associated price bands. We can see that the total energy offered was higher in 2018, which can be attributed to the return of Swanbank E. But even more significant is the change in pricing. On average, Stanwell offered 655 MW of extra power at prices less than or equal to $300/MWh.

Higher availability of cheap hydro led to price falls in Tasmania

Tasmanian wholesale electricity prices fell by 25% in 2018, the second biggest fall in the NEM. The biggest price reductions occurred in the second and third quarter of 2018 as shown in Figure 4. Electricity demand tends to peak in Tasmania during this time. Figure 4 shows that peak demand was 4% lower in 2018 compared with 2017, which eased pressure on prices. However, the far bigger factor had to do with the bidding behaviour of hydro power.

State owned hydro generation has close to a complete monopoly over the Tasmanian market. Figure 5 shows the drastic change in bidding behaviour from April to September in 2018 versus 2017. In 2018, hydro power stations offered an average of 627 MW of extra power at a price of less than or equal to $100/MWh. This is significant in any market, but especially so in a small market like Tasmania.

Lower demand eased wholesale electricity prices in NSW

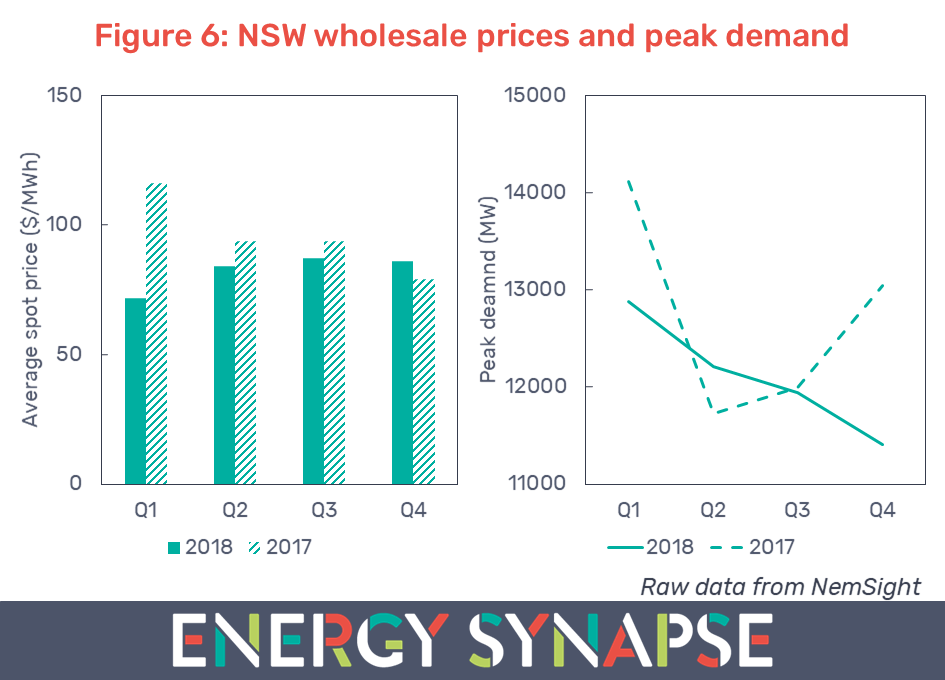

Wholesale electricity prices in NSW fell by 14% in 2018. Similarly to Queensland, the biggest price reduction occurred in Q1 (see Figure 6). The key drivers of the Q1 price decrease were:

(a) Lower demand predominately due to less extreme summer heat and to a lesser extent, growth in behind the meter solar PV. Peak demand in Q1 was 1230 MW (9%) lower than in 2017 (see Figure 6); and

(b) There were fewer periods where high temperature days in NSW coincided with severe weather in other regions.

Victoria and South Australia experienced only slight price reductions

Hazelwood, a 1600 MW brown coal fired power station in Victoria, was closed at the end of March 2017 on very short notice. This left many fearing the worst for Victoria and South Australia for the upcoming summer. AEMO acted swiftly to put together a summer readiness plan, which brought close to 2000 MW of additional resources into the NEM. This included procurement of 884 MW of demand response (with support from ARENA) through the Reliability and Emergency Reserve Trader (RERT), as well as making available previously mothballed gas generation such as Pelican Point in South Australia.

The result was that wholesale electricity prices actually dipped slightly over 2018. 5% in South Australia and 2% in Victoria. However, it should be noted that Victoria was the only state in the NEM to experience higher Q1 prices in 2018 (see Figure 7). As we previously reported, Victoria set a new record for the highest ever wholesale electricity prices during January. There was unusually hot weather and coal fired generation tripped. Unfortunately, all of this also coincided with low wind output. Similar weather conditions prevailed in South Australia, and with Victoria being South Australia’s only point of interconnection, both states experienced volatile pricing.

Nonetheless, without proactive action from AEMO, the situation could have been much worse. Maintaining system security and achieving an overall price reduction in both Victoria and South Australia, however slight, is the best result anyone could have hoped for.

Author: Marija Petkovic, Founder & Managing Director of Energy Synapse

Follow Marija on LinkedIn | Twitter